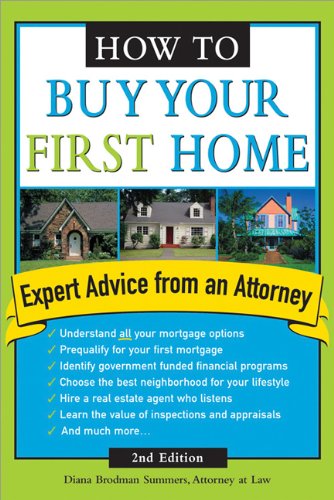

How To Buy Your First Home Second Edition by Diana Summers ISBN 978-1572484979 1572484977

$50.00 Original price was: $50.00.$35.00Current price is: $35.00.

How To Buy Your First Home Second Edition by Diana Summers – Ebook PDF Instant Download/Delivery: 978-1572484979, 1572484977

Full download How To Buy Your First Home Second Edition after payment

Product details:

ISBN 10: 1572484977

ISBN 13: 978-1572484979

Author: Diana Summers

Take the fear out of buying your first home

For many, the process of buying a home for the first time can seem intimidating and overwhelming. How to Buy Your First Home is your resource for information on the subject. This book guides you through the entire process, including:

Preliminaries-Renting versus buying, determining what you can afford, deciding where to live

Searching for Your Home-What to look for in a home, hiring a realtor

Finances-Mortgage basics, government agencies, home loans for veterans

The Buying Process-Weighing your mortgage options, hiring an attorney, making an offer, inspecting and appraising your home

The Future-Caring for your home and increasing the value of your investment

Included within the text are Attorney Tip boxes that highlight important facts. Click on This boxes will guide you to helpful websites for additional information about calculating costs, locating homes in your area and more.

Extensive appendices include a glossary of important terms, contact information for state offices of real estate regulation and sample worksheets to help you as you make your decisions.

Written by an experienced attorney, How to Buy Your First Home is the resource that will take the mystery out of buying a home.

Table of contents:

Section 1: FREQUENTLY ASKED QUESTIONS

Top 20 Questions of First-Time Home Buyers.

Section 2: PRELIMINARIES

Chapter 1: Buying versus Renting

Words

First Time Home Buyers

Financial Reasons

Equity

Tax Advantages

Passing to Heirs

An Investment

Buying vs. Renting

True Cost of Home Ownership

Intangible Reasons

Status

Privacy and Work Schedules

Community

Conclusion

Chapter 2: Qualifying Yourself for a Mortgage

Your Credit History

Credit Reports

Free Credit Reports

Credit Scores

Improving Your Credit Score

Credit Report Errors

Repairing Your Credit Report

Correcting Credit Report Errors

Credit Counseling

Chapter 3: Calculating What You Can Afford

Common Debt-to-Income Ratios

Housing-to-Income Ratio

Debt-to-Income Ratio

How to Use These Ratios

From Monthly Payment to Total Mortgage

Cost of Living Increases.

Your Lifestyle

Chapter 4: Qualifying the Neighborhood

How to Research a Neighborhood

On the Internet

Field Trips

In the Library

From Your Couch

How to Select a Location

The Food Shopping Test

Other Cost of Living Amounts

Public Improvement Plans

Old vs. New

Section 3: SEARCHING FOR YOUR HOME

Chapter 5: Deciding Which House Features

are Important.

The Building, Itself

Features

Essentials

Handy-Man’s Special or Fixer-Upper

We are All Getting Older

Condominiums and Townhomes

Building from the Ground-Up

Building Your House

Buying in a Builder’s Development

Advantages/Disadvantages of Building

Chapter 6: Working with

Real Estate Agents and Brokers

Real Estate Professionals

The Real Estate Profession

contents

Problems with Real Estate Agents

Changing Agents

Whose Interest is Protected by the Real Estate Agent

How Real Estate Agents get Paid

Multiple Listing Services (MLS)

Comparables

Viewing a House Up for Sale

Notes and Checklists

Home Warranty

Home Inspection

What Not to Say to Real Estate Agents and Sellers

Games Played to Make the Sale

Inflating the Worth of the House

Another Offer

When Do You Legitimately Need to Act Fast

Chapter 7: Handling the Emotional Side of a

Home Purchase

Emotions in House Hunting

Under a Deadline

House is Beautifully Decorated

It is a Real Steal

Using the Seller’s Emotions

Buyer’s Remorse

When Buyer’s Remorse is Legitimate

Legal Consequences of Allowing Buyer’s Remorse to Run

Amuck

Section 4: FINANCES

Chapter 8: Explanation of Mortgage Basics.

Pub

Prequalifying

Preapproval

Mortgage Lender Types

Portfolio Lenders

Mortgage Bankers

Direct Lenders

Mortgage Brokers

What Does This Mean for You

Mortgage Types

Adjustable Rate Mortgage (ARM)

Millions of documents at your fingertips, ad-free.

Ticharger for the public

Sign up for a free trial

Assumable Mortgages

Balloon Mortgages

Buy-Down Mortgage

Convertible ARM

Deferred Interest Mortgage

Faith Financing

Fixed-Rate Mortgage

Subprime Mortgage

Wraparound Mortgage

Zero Down Mortgage

Necessary Documents to Apply for a Mortgage

Internet Mortgages

Your Mortgage is Approved, Now Lock-In That Rate

Your Mortgage is Not Approved

Points

Chapter 9: Government Agencies and the Secondary Mortgage Market

Housing and Urban Development Agency (HUD)

Federal Housing Administration (FHA)

Ginny Mae

Fannie Mae

Freddie Mac

Government Agencies and the First-Time Home Buyer

Secondary Mortgage Market

Chapter 10: Additional Sources of Money.

Living Together

Roommates

Friends and Relatives

Retirement Savings

Local Government Assistance

Zero Down Payment

Low Interest Mortgages

Renting with an Option to Buy

Pluses

Minuses

Chapter 11: VA Guaranteed Home Loans

Qualifying VA Appraisal

The Loan

Approval

Advantages

Disadvantages

Section 5: THE BUYING PROCESS

Chapter 12: The Legal Side of Real Estate.

Do I Need an Attorney

Title Searches and Surveys

How to Hold Title

Joint Tenancy

Tenancy by the Entireties

Tenancy in Common

Chapter 13: The Offer.

The Contract

What is in a Real Estate Contract Components of a Real Estate Contract

Negotiation

Things to Remember in Negotiations

Earnest Money

Escrow

Chapter 14: Appraisers, Inspectors, and Homeowners Insurance

Appraisers

Inspectors

The Inspection

Defects

Insurance

Home Insurance

Flood Insurance

Mortgage Insurance

Title Insurance

Chapter 15: The Closing.

The Walk Through

What Really Happens at a Closing

Closing Documents

What to Bring to the Closing

Closing Costs

Problems

Section 6: THE FUTURE

Chapter 16: Enjoying Your Home

Responsible Home Ownership

Keeping Utility Expenses Down

Correspondence from the Mortgage Company

Congratulations-You Get a Tax Benefit

Reducing Your Mortgage Debt

Chapter 17: Foreclosure and How to Avoid

Preventing Foreclosure

When You Can’t Pay the Mortgage

Federal Housing Authority (FHA), Fannie Mae, and Freddie Mac

Sraving Positive

People also search for:

how to buy your first home

how to buy your first home with bad credit

how to buy your first home with no money

how to buy your first home with low income

phil spencer how to buy your first home

Tags: Diana Summers, Buy Your First