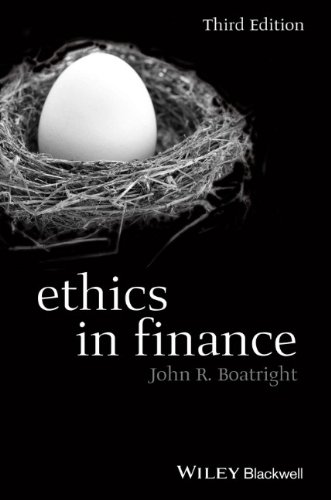

Ethics in Finance 3rd Edition by John R Boatright ISBN 1118615824 9781118615829

$50.00 Original price was: $50.00.$35.00Current price is: $35.00.

Ethics in Finance 3rd Edition John R. Boatright Digital Instant Download

Author(s): John R. Boatright

ISBN(s): 9781118615829, 1118615824

Edition: 3

File Details: PDF, 1.74 MB

Year: 2014

Language: english

Ethics in Finance 3rd Edition by John R Boatright – Ebook PDF Instant Download/Delivery: 1118615824, 9781118615829

Full download Ethics in Finance 3rd Edition after payment

Product details:

ISBN 10: 1118615824

ISBN 13: 9781118615829

Author: John R Boatright

The third edition of Ethics in Finance presents an authoritative and wide-ranging examination of the major ethical issues in finance. This new edition has been expanded and thoroughly updated with extensive coverage of the recent financial crisis and the very latest developments within the financial world.

Ethics in Finance 3rd Table of contents:

- Acknowledgments

- Abbreviations

- Chapter One Finance Ethics: An Overview

- The Need for Ethics in Finance

- Financial scandals

- Causes of wrongdoing

- Pressure and culture

- Organizational factors

- Innovation

- The Field of Finance Ethics

- Defining the field

- Ethics and law

- Financial markets

- Financial services

- Financial management

- Conclusion

- Notes

- Chapter Two Fundamentals of Finance Ethics

- A Framework for Ethics

- The elements of ethics

- Markets and firms

- Markets

- Firms

- Market ethics

- Force and fraud

- Wrongful harms

- Market failures

- Roles and relationships

- Agents, Fiduciaries, and Professionals

- Need for agents and fiduciaries

- Duties of agents and fiduciaries

- The role of professionals

- Conflict of Interest

- Defining conflict of interest

- Why conflicts occur in finance

- Examples of conflict of interest

- Managing conflict of interest

- Competition

- Disclosure

- Rules and policies

- Structural changes

- Conclusion

- Notes

- Chapter Three Ethics and the Retail Customer

- Sales Practices

- Deception and concealment

- Examples for analysis

- Responsibility to protect

- Churning, twisting, and flipping

- The ethical issues

- What is churning?

- Suitability

- Credit Cards

- Ethical concerns

- Marketing to students

- Assessing creditworthiness

- Marketing on campus

- Rates and fees

- Fairness with cards

- Capping rates

- Mortgage Lending

- Rise and fall of subprime

- Securitization

- What went wrong?

- Predatory lending

- Toxic products

- Perverse incentives

- The aftermath

- Arbitration

- Compulsory arbitration

- Hardball legal tactics

- Problems with arbitrators

- Punitive damages

- Conclusion

- Notes

- Chapter Four Ethics in Investment

- Mutual Funds

- Market timing

- How timing works

- What is wrong with timing?

- What should be done

- Personal trading

- Scope of the problem

- Banning personal trading

- Remaining questions

- Soft-dollar brokerage

- Relationship Investing

- RI as an investment strategy

- RI and fiduciary duty

- Improving corporate governance

- Socially Responsible Investing

- Defining SRI

- Can SRI make a difference?

- SRI and fund performance

- SRI and investment policy

- Microfinance

- How microfinance works

- Ethical issues in microfinance

- Effectiveness of microfinance

- The microfinance schism

- Conclusion

- Notes

- Chapter Five Ethics in Financial Markets

- Fairness in Markets

- What is fairness?

- Fraud and manipulation

- Equal information

- Equal bargaining power

- Insider Trading

- Insider trading defined

- Debate over insider trading

- Property rights

- Fairness

- Fiduciary duty

- Resolving the debate

- Hostile Takeovers

- Fairness in takeovers

- Takeover tactics

- Table 5.1 Takeover defenses

- Tender offers

- Golden parachutes

- Greenmail

- Role of the board

- Financial Engineering

- Derivatives

- Understanding derivatives

- Problems with derivatives

- Speculation

- Suitability

- High-frequency trading

- How HFT works

- Uses of HFT

- Evaluation of HFT

- Risks of HFT

- Conclusion

- Notes

- Chapter Six Ethics in Financial Management

- The Corporate Objective

- What is shareholder wealth?

- Do firms seek to maximize?

- SWM and social responsibility

- Friedman’s argument

- Problem of social costs

- Risk Management

- What is risk management?

- Ethical issues in risk management

- The failure of risk management

- Ethics of Bankruptcy

- Ethical basis of bankruptcy

- Use and abuse of bankruptcy

- Product liability suits

- Collective bargaining agreements

- Liabilities and obligations

- What is wrong with strategic bankruptcy?

- Fairness and efficiency of Chapter 11

- Personal bankruptcy

- Corporate Governance

- Case for shareholder primacy

- Public policy

- The market

- The shareholder contract

- Solving a contracting problem

- Efficiency of the solution

- Directors and CEO

- Role of boards

- Role of the CEO

- Problems with shareholder primacy

- Conclusion

People also search for Ethics in Finance 3rd:

ethics in finance

importance of ethics in finance

code of ethics in finance

business ethics in finance

importance of ethics in finance pdf

Tags: John R Boatright, Ethics, Finance